Getting The Best Investment Books To Work

Wiki Article

The most effective Expense Guides

Keen on becoming a greater investor? There are numerous guides that can help. Productive traders browse extensively to acquire their abilities and stay abreast of emerging techniques for financial commitment.

Best Investment Books - Questions

Benjamin Graham's The Clever Trader is surely an indispensable guideline for any investor. It handles anything from elementary investing techniques and threat mitigation approaches, to worth investing methods and tactics.

Benjamin Graham's The Clever Trader is surely an indispensable guideline for any investor. It handles anything from elementary investing techniques and threat mitigation approaches, to worth investing methods and tactics.1. The Small E book of Common Sense Investing by Peter Lynch

Created in 1949, this basic work advocates the value of investing which has a margin of basic safety and preferring undervalued shares. Essential-go through for anybody thinking about investing, specifically Those people seeking over and above index funds to detect distinct superior-value prolonged-term investments. In addition, it addresses diversification ideas and also how to stay away from being mislead by industry fluctuations or other investor traps.

This guide offers an in-depth manual on how to come to be A prosperous trader, outlining each of the principles each and every trader should know. Subjects reviewed while in the e-book vary from sector psychology and paper trading tactics, steering clear of popular pitfalls which include overtrading or speculation plus much more - making this reserve important looking at for serious buyers who would like to guarantee they have an in-depth knowledge of elementary investing ideas.

Bogle wrote this detailed e book in 1999 to lose light-weight on the hidden costs that exist inside of mutual resources and why most investors would profit more from investing in reduced-charge index resources. His advice of saving for rainy day funds when not placing your eggs into just one basket and investing in affordable index money continues to be legitimate now as it had been back then.

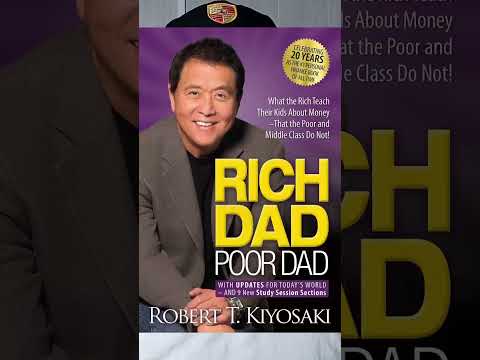

Robert Kiyosaki has lengthy championed the value of diversifying profits streams as a result of housing and dividend investments, particularly housing and dividends. When Abundant Dad Weak Father may tumble extra into personalized finance than private progress, Wealthy Dad Inadequate Dad continues to be an educational read through for any person wishing to better comprehend compound desire and how to make their revenue do the job for them rather then from them.

For anything far more modern, JL Collins' 2019 e-book can provide some Substantially-necessary point of view. Intended to handle the requirements of financial independence/retire early communities (FIRE), it concentrates on reaching fiscal independence through frugal living, cheap index investing as well as 4% rule - and also ways to reduce scholar loans, put money into ESG belongings and reap the benefits of on line investment decision means.

two. The Little Reserve of Stock Current market Investing by Benjamin Graham

Keen on investing but unsure the best way to continue? This ebook features useful steerage prepared specially with youthful buyers in your mind, from substantial college student loan personal debt and aligning investments with personalized values, to ESG investing and on the net financial methods.

This most effective expense e book reveals you ways to establish undervalued shares and build a portfolio that could give a continual source of cash flow. Employing an analogy from grocery searching, this finest e-book discusses why it is much more prudent not to deal with highly-priced, perfectly-marketed merchandise but as an alternative consider minimal-priced, overlooked ones at profits selling prices. On top of that, diversification, margin of security, and prioritizing value about progress are all talked about thoroughly during.

A basic in its area, this e book explores the fundamentals of benefit investing and how to determine options. Drawing on his investment organization Gotham Resources which averaged an yearly return of forty % all through 20 years. He emphasizes staying away from fads when acquiring undervalued businesses with potent earnings potential clients and disregarding short-phrase market place fluctuations as critical ideas of profitable investing.

This very best financial commitment guide's creator presents information for new investors to steer clear of the issues most novices make and optimize the return on their cash. With phase-by-step Directions on creating a portfolio made to steadily expand over time along with the author highlighting why index funds offer quite possibly the most economical suggests of expense, it teaches viewers how to maintain their strategy in spite of industry fluctuations.

Some Known Questions About Best Investment Books.

Despite the fact that first revealed in 1923, this book continues to be an invaluable guideline for check here anyone serious about running their funds and investing wisely. It chronicles Jesse Livermore's ordeals - who gained and missing tens of millions about his lifetime - though highlighting the significance of probability principle as Component of selection-producing processes.

Despite the fact that first revealed in 1923, this book continues to be an invaluable guideline for check here anyone serious about running their funds and investing wisely. It chronicles Jesse Livermore's ordeals - who gained and missing tens of millions about his lifetime - though highlighting the significance of probability principle as Component of selection-producing processes.When you are searching for to improve your investing capabilities, you will discover several excellent books out there that you should decide on. But with confined several hours in a day and limited accessible reading material, prioritizing only All those insights which provide essentially the most price is often demanding - Which is the reason the Blinkist application offers these types of easy access. By accumulating crucial insights from nonfiction textbooks into Chunk-sized explainers.

3. The Small Book of Benefit Investing by Robert Kiyosaki

The Buzz on Best Investment Books

This book more info addresses investing in firms by having an economic moat - or competitive edge - including an financial moat. The author describes what an economic moat is and offers samples of a number of the most renowned firms with just one. In addition, this reserve particulars how to determine a firm's worth and buy shares according to cost-earnings ratio - ideal for newbie traders or anybody planning to learn the basics of investing.

This book more info addresses investing in firms by having an economic moat - or competitive edge - including an financial moat. The author describes what an economic moat is and offers samples of a number of the most renowned firms with just one. In addition, this reserve particulars how to determine a firm's worth and buy shares according to cost-earnings ratio - ideal for newbie traders or anybody planning to learn the basics of investing.This doorstop financial investment e book is the two well known and comprehensive. It covers most of the ideal practices of investing, including starting younger, diversifying broadly and not spending superior broker costs. Prepared in an engaging "kick up your butt" design and style which can both endear it to viewers or change you off fully; while masking many common pieces of recommendation (make investments early when Other people are greedy; be cautious when Other folks become overexuberant), this textual content also recommends an indexing approach which closely emphasizes bonds when compared to lots of comparable procedures.

This e-book provides an insightful approach for inventory finding. The writer describes how to select successful stocks by classifying them into 6 distinctive classes - gradual growers, stalwarts, rapid growers, cyclical shares, turnarounds and asset performs. By following this easy technique you improve your odds of beating the market.

Peter Lynch is amongst the environment's premier fund supervisors, owning run Fidelity's Magellan Fund for thirteen decades with a mean return that beat the S&P Index yearly. Revealed in 2000, his guide highlights Lynch's philosophy for choosing stocks for particular person buyers within an obtainable method that stands in stark distinction to Wall Street's arrogant and overly specialized tactic.